Best Small Business credit cards can help starter business owners manage their finances and earn rewards for purchases. A small business credit card is similar in bonus structure to a consumer credit card, but an important difference is that it may also offer rewards for more business-oriented spending categories, such as office supplies, telecommunications, and even social media or SEO services.

Before selecting a business credit card, you’ll want to first be aware of your cash flow — how much you’re spending and where you’re spending it — as well as how much time you want to invest in redeeming rewards. And you’ll need to decide how high you’d like your credit limit to be. That can be tricky since you don’t want to bite off more than you can chew financially, which could damage your existing good or excellent credit. You’ll also want to ensure you’ll actually be purchasing things that fall into your card’s “eligible purchase” bucket. These factors will help you determine which card works best for your business’s financial needs.

Best Small Business Credit Cards

Ready to take your charge card to the next level and start earning business rewards? We did a deep dive to figure out which business credit cards have the best perks (like a sign up bonus) and the lowest fees. Here are the best business credit card options for business owners. We update this list periodically.

Best overall cash-back rewards

American Express Card

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

- Annual fee: $0 (see rates and fees)

- Reward rates: 2% cash back on all eligible purchases on up to $50,000 per calendar year (then 1%). Cash back earned is automatically credited to your statement.

- Welcome bonus: None

- Bonus redemption threshold: N/A

- APR: 13.24% to 19.24% variable (0% intro APR on purchases for first 12 months from date of account opening) (see rates and fees)

The Blue Business Cash credit card from American Express has two features that stand out: It has the highest flat cash-back reward rate of all the no-annual-fee cards we evaluated, and it has automatic reward redemption. The first feature speaks for itself, but the second is sneakily awesome. Most credit cards require you to log in and manually redeem points or miles when you hit a certain threshold (such as 2,500 points or $25). The Blue Business Cash card, in contrast, automatically applies your cash rewards to your account, so you save money without even thinking about it.

The only downside here is the lack of a welcome bonus. Otherwise, this card offers all of the standard features you want in a business credit card: Up to 99 employee cards for no additional charge (see rates and fees) and an account manager, spending summaries organized by category and the American Express Business App, which helps manage receipts.

Best welcome bonus

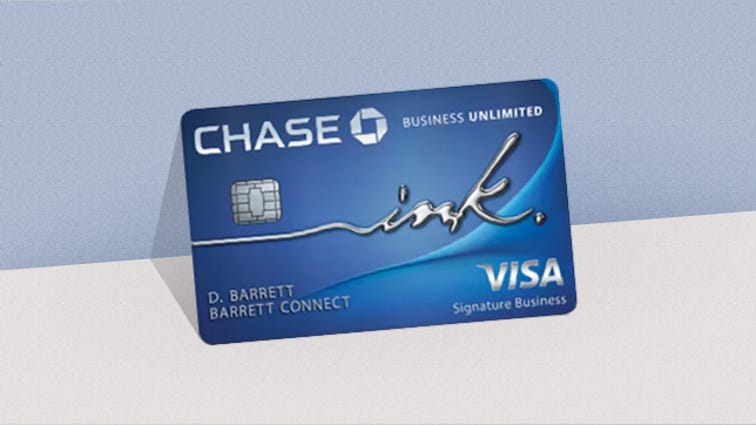

JPMorgan Chase Card

- Annual fee: $0

- Reward rates: Unlimited 1.5% cash back on all purchases

- Welcome bonus: $750 cash back

- Bonus redemption threshold: Spend $7,500 in first three months of card ownership

- APR: 13.24% to 19.24% variable (0% intro APR on purchases for first 12 months)

Another straightforward option for small business owners, the Chase Ink Business Unlimited offers reward rates that are lower than the Blue Business Cash card, but there’s a compelling $750 cash back bonus if you spend at least $7,500 during your first three months. (Because the reward difference is only half of a percentage point, you’d need to spend more than $150,000 on the AmEx to offset the difference.) If that $7,500 threshold isn’t out of reach given typical spending, the Chase Ink Business Unlimited card could be a solid choice.

Best cash-back runner-up

Capital One Spark Cash Select for Business

Capital One Card

- Annual fee: $0

- Reward rates: Unlimited 1.5% cash back on all purchases

- Welcome bonus: $200 cash back

- Bonus redemption threshold: Spend $3,000 in first three months from account opening

- APR: 13.99% – 23.99% variable (0% intro APR on purchases for nine months)

The Capital One Spark Cash Select for Business credit card offers reward rates that are comparable to the Chase Ink Business Unlimited’s. But it also has a more modest $200 welcome bonus (and a lower spending threshold). If you don’t forecast hitting Chase’s $7,500 mark, the Capital One Spark Cash card could be a good alternative.

Note that Capital One also offers a version of the Spark Cash card (the Capital One Spark Cash for Business) that features a $95 annual fee (waived for the first year) and a flat 2% cash-back reward rate. If you plan to spend at least $75,000 annually on your credit card, this upgrade is well worth the fee.

Best cash-back runner-up

Wells Fargo Card

- Annual fee: $0

- Reward rates: Unlimited 1.5% cash back on all purchases

- Welcome bonus: $300 cash back

- Bonus redemption threshold: Spend $3,000 in first three months of card ownership

- APR: 11.24% to 21.24% variable (0% intro APR on purchases and balance transfers for the first nine months)

The Wells Fargo Business Platinum offers 1.5% cash back on all purchases (with no limit) but a smaller welcome bonus than the Chase and Capital One cards. That said, the spending threshold to unlock that bonus is also lower, $3,000, which could be attractive to smaller businesses.

Best for big office supply and telecom spenders

JPMorgan Chase Card

- Annual fee: $0

- Reward rates: 5% cash back on first $25,000 spent annually at office supply stores, internet, cable and phone services; 2% cash back on first $25,000 spent annually at gas stations and restaurants, 1% on everything else

- Welcome bonus: $750 cash back

- Bonus redemption threshold: Spend $7,500 in first three months of card ownership

- APR: 13.24% to 19.24% variable (0% intro APR on purchases for first 12 months)

The Chase Ink Business Cash credit card is a good choice for small businesses that spend between $15,000 and $25,000 annually on office supplies and telecom services. If your spending is less predictable — or concentrated in other categories — one of the flat-rate cash-back cards profiled above is a better choice.

Best overall travel rewards

American Express Card

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

- Annual fee: $0 (see rates and fees)

- Reward rates: 2x Membership Rewards points on the first $50,000 in spending annually; 1x Membership Rewards points on purchases thereafter

- Welcome bonus: None

- Bonus redemption threshold: N/A

- APR: 13.24% to 19.24% variable (0% intro APR on purchases for 12 months from date of account opening; see rates and fees)

The Blue Business Plus credit card offers 2x Membership Rewards points on purchases (on up to $50,000 per year, then 1x), which translates to a net return of 2% to 4%. (To determine the value of rewards, bonuses, and points, we take the average of the most recent The Points Guy and NerdWallet valuations, and apply it to the reward rate.)

Remember that travel redemptions are often maximized when transferring to a partner travel program. If you redeem your points as a statement credit, you’ll get around 0.6 cent per point. If you redeem them through the AmEx travel portal, you should get around 1 cent per point, and if you transfer them to an affiliate travel partner, you can earn up to 2 cents per point according to the most recent The Points Guy valuations.

Best for big advertising spenders

JPMorgan Chase Card

- Annual fee: $95

- Reward rates: 3x points on shipping, advertising with social media sites and search engines, internet, cable and phone services, travel (on up to $150,000 in combined purchases each year); 1x points on all other purchases

- Welcome bonus: 100,000 points

- Bonus redemption threshold: Spend $15,000 in first three months of card ownership

- APR: 15.99% to 20.99% variable

Best for big airfare and restaurant spenders

American Express Card

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

- Annual fee: $295 (see rates and fees)

- Reward rates: 4x points on the two categories where your business spent the most each billing cycle (on up to $150,000 in combined purchases each calendar year, then 1x): airfare purchased directly from airlines; US online, TV and radio advertising; certain US technology purchases; US gas stations; US restaurants; US shipping. 1x points on other purchases

- Welcome bonus: 70,000 points

- Bonus redemption threshold: Spend $10,000 on eligible purchases in first three months of card membership

- APR: 14.24% to 22.24% variable (see rates and fees)

Best business credit card for big travel spenders

American Express Card

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

- Annual fee: $595 (see rates and fees)

- Reward rates: 5x points on flights and prepaid hotels booked through AmExTravel.com; 1.5x points on eligible purchases of $5,000 or more (up to 1 million additional points per year), 1x on other eligible purchases

- Welcome bonus: 100,000 points

- Bonus redemption threshold: Spend $15,000 on eligible purchases in first three months of card membership

- APR: 14.24% to 22.24% variable (see rates and fees)

In the table below, we’ve outlined the key features of each card to help you determine the best business credit card for your small business.

Frequently asked questions

What is a business credit card?

Business credit cards are specifically geared toward small business owners. They can help you keep your business finances separate from your personal transactions, distribute and manage employee cards and earn rewards in typical small business spending categories.

Like consumer credit cards, business credit cards most commonly come in the form of either cash-back rewards or travel rewards. Cash-back cards offer rewards in the form of cash or statement credit. A statement credit is basically a reduction of the amount you owe the issuer. A travel rewards credit card offers rewards in the form of miles or points. You can redeem miles or points either through the issuer’s travel portal for a small bonus or gift cards or you can transfer them to a partner travel affiliate, like a hotel group or airline. And, like a personal credit card, business cards must be managed carefully to ensure a small business owner doesn’t hurt their business credit score.

What are corporate credit cards?

Corporate credit cards, also known as commercial credit cards, are designed for larger businesses — typically those with 100 or more employees or revenue of at least $10 million.

Should I get a business credit card?

If you spend in concentrated “business” categories — such as office supplies or telecom services — or want to have employee spending on a central credit account, then, yes. You may also appreciate these cards’ business-specific tools like budget trackers and account managers.

If you’re a small business owner, it’s a good idea to keep your business expenses separate from your personal finances — both for tax purposes and to make it simpler to review your spending. But you could just as easily keep your expenses separate, and track them, with a dedicated consumer credit card. As such, the typical rationale for getting a business credit card is to help manage employee cards or earn more rewards from business purchases.

A small-business credit card may not be the best option for a self-employed person, however. Self-employed individuals and sole proprietors may be better served by a consumer-oriented personal credit card from a credit card company — such as a cash-back credit card, travel credit card or student credit card. And larger businesses (usually those with hundreds of employees or multiple millions in sales) will typically be able to negotiate more preferential and flexible terms with their card issuer (e.g., an employee card system or business credit line not tied to someone’s personal credit) within a “corporate” or “commercial” credit card program.

What is the difference between a cash-back business credit card and a travel rewards credit card?

A cash-back rewards credit card typically offers a cash or statement credit — that is, a reduction of the amount you owe. For example, if you redeem $25 worth of cash rewards as a statement credit, your outstanding balance is reduced by $25.

A travel rewards credit card offers miles or point rewards that can be redeemed directly on an issuer’s travel website for a small bonus (usually around 25%) or with a partner affiliate such as a hotel group or airline. You usually get the best redemption value when strategically transferring points or miles, but it will always depend on the specific flight or hotel stay. Sometimes it requires some research and effort to identify maximum-value redemption opportunities. With American Express, for example, you get around 0.6 cents per point when redeeming Membership Rewards points as statement credits, about 1 cent per point when redeeming through the AmEx travel portal and up to two points when you transfer them to a travel partner and then redeem them toward a flight or hotel stay, according to the most recent points valuations from The Points Guy.

We generally prefer cash-back rewards cards, which are often more straightforward. But if you don’t mind some extra work, travel rewards may provide a higher overall reward rate.

How many employee cards can I add to a single account?

It depends on the issuer. Wells Fargo and American Express cap it at 99. Chase doesn’t have an explicit limit. But employee cards are grouped in one central account, which has a cumulative credit limit that is typically spread evenly among the issued cards. That means the more cards on your account, the lower the individual spending limit. A credit limit of $10,000 with 100 employee cards will yield an individual card limit of $100, for example.

Do I need to have good credit to open a business credit card? What if my business doesn’t have an established credit history?

Generally, you need to have a credit rating of around 700 or higher to qualify for a business credit card, unless your business has been around for a while and has demonstrably steady and healthy revenue. As with all credit activities, if you can show that you’re a low-risk borrower, your credit score may have less of an impact.

Different issuers report business credit card activity to credit bureaus in different ways. Some report negative information to both consumer and commercial credit bureaus, some issuers don’t report to either, and some report only to commercial credit bureaus. That’s why it’s a good idea to call your card issuer to ask about how they report business credit card activity, especially if you think you may be maintaining a balance.

How we picked the best business credit cards

We generally recommend credit cards that have no annual fee and straightforward rewards and redemption rules. Though such cards may offer lower reward rates than their more complex cousins, the zero annual fee helps prevent a small business owner from going into the red and potential bad credit. It will save you from sinking your time into comparing redemption charts, transferring points or miles or contorting your spending to make a qualifying purchase that will ensure you hit bonus thresholds. At the end of the day, that time is usually better spent running your business. We also consider factors like whether the card offers a sign-up bonus, cash rewards, balance transfer, bonus points and other benefits.

Learn smart gadget and internet tips and tricks with our entertaining and ingenious how-tos.

More credit card recommendations

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Source by www.cnet.com